News

Politics News

Politics News

Browse all Politics related articles and news. The latest news, analysis, and insights on Politics.

Daily Market Summary with JrKripto 1 May 2025

You can find our article “Daily Market with JrKripto” below, where we have compiled the most important developments in global and local markets. Let's analyze the general market conditions together and take a look at the latest assessments.Bitcoin (BTC) is currently trading at $95,300. With a strong bullish movement starting from the $75,930 support, the price has settled in the $95,000 – $96,000 resistance band. If this region is exceeded, it can be expected that the rise in BTC will continue to the level of $ 101,000. However, the first support point for profit sales that may occur at current levels will be $ 90,500. If it hangs below this level, it is possible for the decline to deepen to the level of $ 86,500.Ethereum (ETH) is trading at $1,810. With the rise that started at the level of $ 1,486, the price continues to stay above $ 1,800. If the upward movement continues, the resistance levels of $1,888 and $1,950 can be targeted. However, $1,790 will be followed as the first support in possible withdrawals. If persistence is achieved below this level, the $1,700 level for ETH will be the next strong support. Persistence above $1,790 is critical for the continuation of the short-term upward trend.Crypto NewsDonald Trump's son Eric has said that banks that do not adopt crypto will disappear within 10 years.Coinbase has added WLD to its listing roadmap.The United States has contacted China for talks on customs tariffs, Chinese media have confirmed this.North Carolina has passed a bill to create a Strategic Bitcoin Reserve.Canary has applied for a spot ETF for SEI.CryptocurrenciesThose Who Have Risen The Most:VIRTUAL →increased by 42.4% to $ 1.77.BEAM →increased by 23.0% to $0.0088351.PRIME →increased by 22.8% to $3.33.AI16Z →increased by 20.8% to $0.30912477.AERO →increased by 20.7% to $0.71983165.The Ones Who Fell The Most:DRIFT → fell by 7.7% to $0.67915288.LAYER → fell 6.7% to $3.01.DCR → fell 5.6% to $13.13.QGOLD → fell 2.3% to $3,225.41.XAUT → fell 2.1% to $3,234.26.Other Data:Fear Index:Bitcoin: 55Ethereum: 49Dominans:Bitcoin: 64.57% ▲ 0.11%Ethereum: 7.48% ▲ 0.08%Total Net ETF Inflows Per Day BTC ETFs: -56.30 Million$ ETH ETFs: -2.30 Million$ Data to Follow TodayMay 1 - Turkish Labor DayApplications for Unemployment BenefitsExpectation: 224KPrevious: 223KManufacturing Purchasing Managers' Index (PMI) (April)Expectation: 50.7Previous: 50,2ISM Manufacturing Purchasing Managers' Index (PMI) (April)Expectation: 48.0Previous: 49.0Global MarketsUS stock markets ended the day yesterday with a mixed and low volume course. However, the strong technology balance sheets announced after the session close, especially Microsoft's 6.9% and Meta's 5.4% increases, caused positive pricing in futures. Nasdaq futures indices were at a premium of up to 1.5%. While positive expectations in the negotiations with the US trading partners are also influential in this optimism, the fact that China has not yet officially participated in this process continues the cautious approach in the markets.The macroeconomic data showed a weak picture. Private sector employment in the US increased by only 62 thousand people and remained well below expectations. This situation shows that companies are being more cautious in hiring, especially due to tariff-related uncertainties. In addition, the US economy contracted by 0.3% in the first quarter of the year. This contraction was based on a higher-than-expected increase in imports and a weakening in personal consumption. While PCE inflation gave mixed signals, it registered a decrease on an annual basis, indicating an easing in price pressures.The ISM Manufacturing PMI data for March has moved back into contraction territory with 49 points. The index, which can only stay in the expansion zone for two months, showed that the contraction in new and accumulated orders slowed down, but employment losses increased. Supply shortages have accelerated price increases, while inventories have grown and delivery times have extended. This index is expected to decline to 48 points in April. Such data is critical for interpreting the impact of tariffs on businesses.On the international front, while the Bank of Japan left its policy rate unchanged, its failure to give clear signals about an interest rate hike led to the weakening of the Japanese Yen. Oil prices, on the other hand, tested 4-year lows with the news that OPEC+ may increase production. The OPEC+ meeting on May 5 will be critical in this sense.In addition, an agreement was signed between Ukraine and the United States on access to Ukraine's natural resources Dec. This development is interpreted as an effort to get support from Kiev's Trump wing before the upcoming elections in the United States.For the rest of the week, the data calendar is quite busy. In particular, the non-agricultural employment data to be announced on Friday is of great importance for the Fed's monetary policy and may be decisive on the direction of the markets. Apple and Amazon balance sheets will be announced today, and the general mood in the technology sector will be clarified with these data.The Most Valuable Companies and Their Stock PricesApple (AAPL) → market capitalization of $3.19T, price per share of $212.50, an increase of 0.61%Microsoft (MSFT) → market capitalization of $2.94T, price per share is $395.26, an increase of 0.31%NVIDIA (NVDA) → market capitalization of $2.66T, price per share of $108.92, down 0.09%Amazon (AMZN) → market capitalization of $1.96T, price per share of $184.42, down 1.58%Alphabet (GOOG) → market capitalization of $1.94T, price per share of $160.89, down 0.72%Precious Metals and Foreign Exchange PricesGold: 3961 TL Silver: 39.31 TL Platinum: 1191 TL Dollar: 38.44 TL Euro: 43.62 TL Hope to meet you again tomorrow with the latest news!

Daily Market Summary with JrKripto 30 April 2025

Below is today's "Daily Market Update with JrKripto," where we compile the most significant developments in global and local markets. Let's analyze the general market conditions together and review the latest assessments.Bitcoin (BTC) is currently trading at $95,090. Following a strong upward movement from the $75,930 support level, the price has settled above $94,000. BTC is now testing the resistance band between $95,000 and $96,000. If this area is surpassed with significant volume, the next target could be $101,000. However, if profit-taking occurs at current levels, the first support is at $90,500. Sustained movement below this level could lead to a correction down to $86,500.Ethereum (ETH) is trading at $1,820. The recovery process that began from the $1,486 support level has maintained the price above $1,800. In the continuation of the upward movement, the $1,888 and $1,950 levels can be monitored as resistance. However, a pullback from the $1,820 level highlights $1,790 as the first support. Below this, a stronger support at $1,700 can be observed. To maintain ETH's current upward trend, staying above $1,790 is critically important.Crypto NewsThe SEC has concluded its investigation into PayPal's PYUSD stablecoin without enforcement action.Trump: "India is doing great; I think we will have an agreement on tariffs."The UK Chancellor states that the United Kingdom aims to be a "world leader in digital assets."The UK will collaborate with the US to increase cryptocurrency adoption.China has lifted the 125% tariff on imported ethanol from the US.CryptocurrenciesTop Gainers:DRIFT → Increased by 31.8% to reach $0.7651.AKT → Increased by 14.7% to reach $1.53.PLUME → Increased by 12.8% to reach $0.1925.AIC → Increased by 10.5% to reach $0.2011.FLOKI → Increased by 10.3% to reach $0.00009251.Top Losers:SAFE → Decreased by 13.9% to $0.5254.PENGU → Decreased by 13.3% to $0.0106.VIRTUAL → Decreased by 10.5% to $1.32.AI16Z → Decreased by 7.2% to $0.2799.DEEP → Decreased by 6.9% to $0.1942.Other Data:Fear Index:Bitcoin: 57Ethereum: 49Dominance:Bitcoin: 64.50% ▲ 0.10%Ethereum: 7.46% ▼ 0.14%Daily Total Net ETF Inflows:BTC ETFs: $172.80 MillionETH ETFs: $18.40 MillionData to Watch TodayADP Non-Farm Employment (April):Expectation: 114K | Previous: 155KGross Domestic Product (GDP) (Quarterly) (Q1):Expectation: 0.2% | Previous: 2.4%Core Personal Consumption Expenditures (PCE) Price Index (Monthly) (March):Expectation: 0.1% | Previous: 0.4%Core PCE Price Index (Annual) (March):Expectation: 2.6% | Previous: 2.8%Energy Information Administration Crude Oil Inventories:Expectation: -0.600M | Previous: 0.244MGlobal MarketsUS stock indices closed higher following optimistic statements on tariffs by Commerce Secretary Lutnick, marking the sixth consecutive positive trading day. The S&P 500 rose by 0.58%, the Dow Jones by 0.75%, and the Nasdaq by 0.55%. All sectors in the S&P 500, except for energy, closed in positive territory. The strongest performing sectors were financials (0.97%), materials (0.92%), consumer staples (0.77%), and real estate (0.74%).On the economic data front, a weak outlook persisted. The Conference Board Consumer Confidence Index fell from 93.9 in April to 86.0, reaching its lowest level in five years. The expectation was 87.7. The expectations index dropped by 12.5 points to 54.4, the lowest since October 2011, remaining below the 80-point level considered a recession indicator for the third consecutive month. The current conditions index declined to 133.5, while consumers' 12-month inflation expectations rose from 6% to 7%, the highest since November 2022. The JOLTS job openings data came in at 7.19 million, below the expectation of 7.49 million, marking the lowest level in four years. The housing price index also recorded a lower-than-expected increase.Asian markets showed mixed trends, while European markets are expected to start the day flat. Today, US markets will focus on Q1 GDP data, PCE inflation data, and ADP private sector employment data.Most Valuable Companies and Stock PricesApple (AAPL) → Market Cap: $3.17T, Share Price: $211.21, ▲ 0.51%Microsoft (MSFT) → Market Cap: $2.93T, Share Price: $394.04, ▲ 0.74%NVIDIA (NVDA) → Market Cap: $2.66T, Share Price: $109.02, ▲ 0.27%Amazon (AMZN) → Market Cap: $1.99T, Share Price: $187.39, ▼ 0.17%Alphabet (GOOG) → Market Cap: $1.95T, Share Price: $162.06, ▼ 0.22%Borsa IstanbulA weak outlook and capital outflows continue in Borsa Istanbul. Yesterday, the BIST 100 index fell below the 9,250 support level, with technical indicators showing clear sell signals. This decline positions the 9,000 – 9,100 range as the next support area. On the upside, the 9,250 – 9,300 band now serves as resistance. Given that today is the last trading day of April, the closing of arbitrage positions in VIOP share contracts and the stock market may create additional selling pressure on BIST.The Central Bank's weighted average funding cost (WAFC) remains close to 49%. Q1 financial results have generally been weak, though some stocks like ASELS and TABGD have shown positive performance. However, the expected strong outlook for the earnings season has not been achieved. Today's agenda includes Koç Holding (KCHOL) financial results, domestic foreign trade data, growth data in Europe, and employment, housing, and consumption-focused data in the US.Turkey's 5-year CDS premium has risen to 362 basis points, showing an upward trend contrary to the average of emerging markets. This indicates an increased risk perception specific to TL assets and the continuation of foreign sales in BIST.The unemployment rate fell to 7.9% in March, seasonally adjusted, reaching the lowest level in the series. However, the underemployment rate increased over the past three months, reaching 28.8%, the highest since June 2023. The labor force participation rate stood at 53.4%. The Economic Confidence Index for April decreased by 4.2% monthly to 96.6, marking the sharpest decline since August 2023. The subcomponents of the index indicate weakened expectations on both the consumer and producer sides.Yesterday, sales in aviation stocks determined the direction of the index, and the BIST 100 closed the day with a 0.9% loss. Generally weak earnings and rising interest rates are increasing pressure on the index. A selling trend is expected to continue in Borsa Istanbul today.The BIST 100 index fell to 9,217 yesterday before closing at 9,225. The 9,221 level is being monitored as short-term support, while the 9,044 – 8,870 range serves as a stronger support area due to previous lows. As long as the index stays above this region, rebound buying may occur. Otherwise, a stronger decline towards the 8,618 – 8,500 band could be experienced. On the upside, the 9,494 – 9,594 band stands out as near-term resistance. If this band is surpassed, movement towards the 9,740 – 9,895 range may be seen. Support levels for BIST 100: 9,221 – 9,044 – 8,870 – 8,725 – 8,618; resistance levels: 9,494 – 9,594 – 9,740 – 9,895 – 9,953.Most Valuable Companies in Borsa Istanbul (According to Visual Data):QNB Finansbank (QNBTR) → Market Cap: 938 billion TL, Share Price: 270.50 TL, ▼ 3.39%Aselsan Elektronik Sanayi (ASELS) → Market Cap: 626.54 billion TL, Share Price: 132.90 TL, ▼ 3.28%Türkiye Garanti Bankası (GARAN) → Market Cap: 430.08 billion TL, Share Price: 101.70 TL, ▼ 0.68%Türk Hava Yolları (THYAO) → Market Cap: 410.89 billion TL, Share Price: 289.00 TL, ▼ 2.94%ENKA İnşaat ve Sanayi (ENKAI) → Market Cap: 373.11 billion TL, Share Price: 63.80 TL, ▲ 0.24%Precious Metals and Exchange RatesGold: 4091 TLSilver: 39.97 TLPlatinum: 1201 TLUSD: 38.50EURO: 43.90

The Spot Crypto ETF Era Begins in South Korea: A Wind of Pre-Election Reform

South Korea Set to Take Major Steps in the Digital Asset SpaceAhead of the early presidential elections scheduled for June 3, the ruling People Power Party (PPP) has unveiled reform plans aimed at energizing the crypto market.Single Bank Requirement to Be RemovedThe PPP intends to remove the current rule that allows crypto exchanges to operate with only one bank.The new regulation would enable exchanges to partner with multiple banks, a move expected to increase investor access and boost competition.Legal Framework for Spot Crypto ETFsOne of the most notable pledges: Spot Bitcoin and altcoin ETFs are expected to become legally approved within this year.The PPP argues that such products would offer a safe entry point for institutional investors.Citing the growing interest in the U.S., the party believes South Korea must not fall further behind in this area.Digital Assets Promotion Act in the WorksThe PPP also plans to introduce a new legislative framework titled the “Basic Act for the Promotion of Digital Assets.”Key goals include:Clarifying listing criteriaStrengthening transparency regulationsCreating a legal foundation for security tokens (STOs)Ensuring international compliance for stablecoinsA special Digital Assets Committee, directly reporting to the president, is also under consideration to oversee the entire process.Crypto Policies Take Center Stage in Election CampaignPPP’s presidential candidate Hong Joon-pyo is campaigning on a promise to liberalize crypto regulations.He drew attention with his statement: “We will roll back regulations just like the Trump administration did.”Crypto is now not only an economic issue but a central theme in the broader political message.Parallel Announcements from RegulatorsThe Financial Services Commission (FSC) is also preparing new regulations.In January, it was announced that restrictions on institutional investors' crypto activities would be eased.The upcoming regulations will cover areas such as stablecoins, listing rules, and market transparency.Digital Transformation to Be Shaped by Election OutcomeSouth Korea is entering a new phase in crypto reform.With spot ETFs, flexible banking rules, and legal frameworks, the country could become one of Asia’s leading crypto hubs.However, the future of this transformation hinges on the election outcome.If the PPP wins, reforms could be implemented rapidly — the opposition’s stance, however, remains unclear.

Daily Market Summary with JrKripto 29 April 2025

You can find today’s “Daily Market with JrKripto” article below, where we compiled the most important developments in global and local markets. Let’s analyze the general market conditions together and take a look at the latest evaluations.Bitcoin (BTC) is currently trading at $94,700. The price has strongly continued the upward trend that started from the $75,930 support level and has now surpassed the $94,000 levels. Currently hovering near the $95,000 – $96,000resistance zone, a breakout from this region could bring $101,000 into focus. However, if profit-taking occurs around $95,000, the first support lies at $90,500. If this level is broken downward, $86,500 will be the next support level to watch.Ethereum (ETH) is trading at $1,824. The price continues its recovery that began from the $1,486 support. If the upward movement continues from the current level, the resistance levels to watch will be $1,888, followed by $1,950. On possible pullbacks, $1,790 will act as the first defense level. If that level fails, $1,700 will be the stronger support. To maintain the uptrend in ETH, staying above $1,790 is important.Crypto NewsCircle ($USDC) received approval to operate as a money services provider in Abu Dhabi, UAE.South Korea plans to approve spot crypto ETF trading later this year.Arizona became the first U.S. state to pass a $BTC reserve bill allowing 10% of public funds to be invested in virtual assets like Bitcoin. The bill now awaits Democratic Governor Katie Hobbs’ signature to become law.Standard Chartered predicts a new all-time high (ATH) for Bitcoin in Q2.U.S. Treasury Secretary Bessent says the first trade deal may be finalized this week or next.MicroStrategy purchased 15,355 BTC.Tether minted $1 billion in USDT.Top Gainers in Cryptocurrencies:SAFE → up 27.9%, now at $0.5898LAYER → up 15.0%, now at $3.12BABY → up 10.8%, now at $0.0926VIRTUAL → up 10.3%, now at $1.44MOCA → up 8.3%, now at $0.0968Top Losers:POPCAT → down 14.6%, now at $0.3684DEEP → down 11.1%, now at $0.2071WIF → down 10.3%, now at $0.5922TRUMP → down 9.7%, now at $13.75KAITO → down 9.6%, now at $0.9009Other Metrics:Fear Index:Bitcoin: 58Ethereum: 49Dominance:Bitcoin: 64.23% ▼ -0.25%Ethereum: 7.51% ▲ +1.25%Daily Total Net ETF Inflows:BTC ETFs: $591.20 millionETH ETFs: $64.10 millionData to Watch Today:Conference Board (CB) Consumer Confidence (April): Forecast: 87.7 | Previous: 92.9Job Openings and Labor Turnover Survey (JOLTS) (March): Forecast: 7.490M | Previous: 7.568MGlobal MarketsU.S. stock markets started the week positively with a heavy flow of economic data and earnings reports but couldn’t maintain gains and ended the day flat.S&P 500: +0.06%Dow Jones: +0.28%Nasdaq: -0.10%8 out of 11 major sectors closed in the green. The top performers were:Infrastructure: +0.70%Real Estate: +0.68%Energy: +0.63%Sectors underperforming included:Technology: -0.30%Consumer Staples & Discretionary: -0.15% eachEuropean markets also ended the day mostly flat to slightly positive.Today, company earnings will be the focus, especially from Visa, Coca-Cola, Spotify, and Mondelez, which will be key in assessing consumer trends and corporate outlooks.On the data side, the U.S. will release:Consumer confidenceJOLTS (Job openings)Trade balanceHousing pricesIn March, the trade deficit fell by $7.7B to $147.9B. JOLTS showed open jobs declined by 194K to 7.57M, with a hiring rate of 3.4%. Layoff and quit rates were stable at 1.1% and 2.0%, respectively.ECB will release March inflation expectations today. Asian markets showed mixed performance, while European indexes are expected to open higher.Most Valuable Companies & Stock PricesApple (AAPL) → $3.16T market cap, $210.14/share, ▲ 0.41%Microsoft (MSFT) → $2.91T, $391.16/share, ▼ 0.18%NVIDIA (NVDA) → $2.65T, $108.73/share, ▼ 2.05%Amazon (AMZN) → $1.99T, $187.70/share, ▼ 0.68%Alphabet (GOOG) → $1.97T, $162.42/share, ▼ 0.87%Borsa Istanbul (BIST)Rising interest rates, weak earnings, and ongoing risks have kept the BIST 100 index tightly ranged between 9250–9500for nearly a month.Yesterday, the index dropped 1.3%, closing at 9307, with banking stocks falling 3.2%, diverging negatively.Technical levels to watch:Support: 9250 → 9100/9000 → 8870/8618Resistance: 9390 → 9500 → 9580 → if broken, a move to 9740–9895 is possibleUpcoming Turkish data:March unemployment rateApril economic confidence index (previous: 100.8, decline expected)CDS risk premium started the day at 357 bps.Both technical and fundamental indicators suggest staying cautious on BIST.Top Companies by Market Cap in BISTQNB Finansbank (QNBTR) → ₺927.95B, ₺281.00/share, ▲ 1.44%Aselsan (ASELS) → ₺632.02B, ₺138.20/share, ▼ 0.29%Turkish Airlines (THYAO) → ₺431.60B, ₺301.75/share, ▼ 3.52%Garanti Bank (GARAN) → ₺425.46B, ₺101.90/share, ▲ 0.59%ENKA (ENKAI) → ₺376.33B, ₺63.55/share, ▼ 1.01%Precious Metals & FXGold: ₺4,086Silver: ₺41.18Platinum: ₺1,227USD/TRY: ₺38.43EUR/TRY: ₺43.82Looking forward to seeing you again tomorrow with the latest updates!

US Treasury Secretary Scott Bessent: "The Difficult Process with China Continues"

A New Era in U.S. Trade Policy: Deal with India Expected SoonA new chapter in U.S. trade policy is unfolding. Treasury Secretary Scott Bessent announced that a trade agreement with India could be finalized as early as next week.Bessent’s remarks signal that Washington is now pursuing a more aggressive trade strategy in the Asian market.Rapid Progress with India, Japan, and South KoreaBessent noted that significant progress is being made not only with India but also in ongoing trade talks with Japan and South Korea.These developments highlight the swift implementation of the U.S. strategy to expand its trade network across Asia and reduce economic dependence on China.A potential deal with India, in particular, could elevate economic cooperation between the world's two largest democracies to an unprecedented level.Negotiations with China: A Tough Road AheadHowever, the same level of success has yet to be achieved in negotiations with China.Bessent emphasized that China must take more concrete steps, warning that the current state of trade tensions is unsustainable.He stressed that efforts to ease tensions would require China to adopt a more constructive attitude.The slow pace of talks with China has led the U.S. to place greater emphasis on strengthening economic partnerships elsewhere in the Indo-Pacific region.Critical White House Press Conference ScheduledThe White House has announced that Scott Bessent will hold a press conference on April 29, 2025.During the event, Bessent is expected to share key details about the potential trade agreement with India, steps regarding tariff adjustments, and the broader outline of America’s new trade strategies.Although the official agenda has not yet been released, the press conference is anticipated to deliver crucial messages concerning U.S. policies in Asia and global trade dynamics.The U.S. Pursues a New Balance in Trade StrategyBessent’s statements suggest a shift toward a more pragmatic and results-oriented U.S. trade policy.While aiming for quick, tangible gains with partners like India, Japan, and South Korea, Washington appears to be adopting a more patient and strategic approach toward China.This strategy is likely to have not only economic but also geopolitical consequences.The future of U.S.-China tensions will impact not just bilateral relations but also the stability of global financial markets.A New Trade Push in Asia BeginsAs the U.S. accelerates its trade initiatives in the Indo-Pacific region, it is preparing to take a more cautious stance with China.Scott Bessent’s comments are a strong indication that major developments in international trade may unfold in the coming weeks.The details of the potential agreement with India — and how negotiations with China evolve — will be among the key forces shaping the future of the global economy.

China's Clear Response to US Tariff Deal Claims: “There are No Talks”

China Denies Trump’s Claims of Progress on Trade TalksRecent statements from U.S. President Donald Trump regarding progress in trade negotiations with China have been swiftly and firmly denied by Beijing.At a press conference on April 28, 2025, Chinese Foreign Ministry Spokesperson Guo Jiakun announced that there had been no recent phone calls or tariff negotiations between the two countries.China’s Firm Response: “Threats Will Not Solve Anything”Guo Jiakun accused the Trump administration of trying to exert pressure through threats and misinformation.“If the U.S. truly seeks a resolution, it must abandon the language of threats and demonstrate a willingness to negotiate,” Guo said.China’s comments came in response to Trump’s recent interview with Time magazine, where he claimed to have spoken directly with Chinese President Xi Jinping and suggested that the two sides were close to a tariff agreement.Beijing, however, categorically rejected these claims, labeling them as attempts to mislead the public and clarified that no new negotiation process has been initiated.Trump’s Claims vs. RealityPresident Trump recently announced that the U.S. had raised tariffs on Chinese imports to 145%, claiming it was benefiting the American economy.However, China strongly refuted Trump’s assertions, emphasizing that no new negotiations concerning tariffs are currently underway.The conflicting narratives underscore that a resolution to the long-running U.S.-China trade war remains a distant prospect.Mounting Pressures on the Global EconomyThe ongoing trade tensions between the U.S. and China continue to disrupt global economic stability.Tariffs exceeding 100% on both sides have led to increased costs across numerous industries and caused significant supply chain disruptions.According to a recent Reuters report, China has temporarily exempted certain critical U.S. imports from the steep 125% tariffs.Nevertheless, broader economic relations remain strained, with Chinese officials warning that U.S.-imposed tariffs are jeopardizing the fragile global economic recovery.Trust Is Low, But Hope Remains in Trade TalksChina’s firm stance highlights the fragile state of trust between the two nations.The deep divide between Trump’s aggressive tariff policies and China’s rebuttals suggests that tensions could escalate further in the near future.However, the fact that both sides are publicly acknowledging the seriousness of the situation may eventually lay the groundwork for more stable and reliable negotiations.The coming weeks will be critical — positive steps from both parties could gradually reduce uncertainty and bring much-needed stability to global markets.

Trade Tensions Between the Trump and Chinese Decrees

US President Donald Trump expects a trade deal with China in the next three to four weekshe explained that he was waiting for the result. However, the Chinese government quickly denied these statements, denying,he announced that no negotiations were held with the United States on customs duties. Thus twothe ongoing trade tension between the countries has gained a new dimension.Dec.US Claims and China's ReactionPresident Trump said in an interview with Time magazine that he had met with Chinese President Xi Jinping andhe said that trade negotiations will be concluded soon. Also imported from Chinastating that they have increased the customs duties they apply to products to 145%, Trump said that this policyHe argued that it reflected positively on the US economy.The Chinese Foreign Ministry, on the other hand, rejected Trump's claims. In the official statement made, with the USAit was stated that no negotiations were conducted on customs duties. China also includes the United Stateswhile inviting the public to refrain from misinformation, we believe that unilateral tariff increaseshe stressed that it had a negative impact on the negotiations.Both Countries Have Turned to Partial ExemptionsThe US has recently temporarily imposed duties on some technology products imported from Chinahe suspended it. Smartphones and computers stand out Decently among these products. But in the general frameworkthe application of high customs duties continues.In October, China imposed additional duties of 125% on some products imported from the United States in responsehe is considering temporarily removing it. This move is an attempt to relieve economic pressureit is being interpreted. USA and China The Global Economy Is Under PressureThe uncertainty created by the trade war between the United States and China continues to affect global markets Decis doing. While investors are being more cautious in this uncertain environment, cost increases in many sectorsand supply chain disruptions are happening. The International Monetary Fund (IMF), on the other hand, by making a call to the leaders,he noted that trade tensions should be resolved quickly, and if the process is prolonged, the globalhe warned that economic growth would suffer.The Uncertainty ContinuesThe future of trade negotiations between the US and China remains uncertain. Dec. Trump's dealdespite the recent statements, the harsh Decrees from China indicate that the tension between the two countries is shortit may be a sign that the term will not end. Investors and the business world are taking these critical developmentswatching closely, he is waiting for when and how the tension will be resolved.

Trump's Clear Message to the Fed: "Lower Interest Rates, Ease the Economy"

US President Donald Trump has called for interest rate cuts again to accelerate economic growth. Describing Fed Chairman Jerome Powell as a "big loser," Trump argued that if interest rates are not cut immediately, the economy could slow down. According to Trump, now is the time for quantitative easing.What is Trump Saying?Trump lashed out at Fed Chairman Powell in his latest statement with very harsh terms. Reminding us that the European Central Bank has cut interest rates seven times this year, he claimed that the US is lagging behind. Trump, who particularly implies that interest rate moves made during election periods have political purposes, has the following prominent messages:Things are going well in customs negotiations.The US will make a lot of money from this process.Inflation is under control and is almost at zero.Interest rate cuts have now become inevitable.How Will Quantitative Easing Affect the Market?Trump's call for a rate cut actually sends a clear signal to the markets: Quantitative easing. Such policies usually mean more liquidity in the markets. As a result:It may create effects such asUpward movements in stock markets,Increase in demand for risky assets,A new wave of rise in cryptocurrencies. This call, especially made at a time when the US is entering an election atmosphere, may signal an early bull period to the markets.Will the Fed Respond to Trump's Call?The Fed, chaired by Jerome Powell, has been taking cautious and careful steps recently. However, with the permanent decline in inflation and signals of a possible slowdown in economic growth, it may open the door to interest rate cuts. These statements by Trump will increase public pressure on the Fed.Is It the Beginning of a New Era for the Markets?Trump's interest rate cut request means much more than a political statement. The desire for monetary expansion behind this call may bring a positive atmosphere to the markets. However, the response the Fed will give will be the most critical factor in determining how financial markets will shape in the coming period.

China's Harsh Response to the US: Customs Duty Has Increased to 125%

The long-running trade war between the United States and China has reached a new flashpoint in the spring of 2025. Following U.S. President Donald Trump’s decision to raise tariffs on Chinese goods to a staggering 145%, Beijing has responded with retaliatory measures. As of April 12, 2025, China announced it will increase tariffs on U.S. imports to 125%.A New Wave of Tension Between Two Global PowersLast week, President Trump accused China of continuing to "exploit" the U.S. economy and announced sweeping tariff hikes. The newly announced 125% tariff, when combined with an earlier 20% penalty tied to fentanyl-related imports, brings the total tariff burden to 145%.In a statement on social media, Trump said, “Hopefully China will now realize that exploiting the United States and other nations is unsustainable.” He also noted that additional tariffs on other countries have been temporarily suspended for 90 days, during which over 75 countries have reportedly entered talks for new trade deals with the U.S.China Hits Back: “These Policies Lack Economic Credibility”China wasted no time in issuing a forceful response. The Ministry of Finance criticized Washington’s actions, stating that such trade moves are “economically irrational” and “will be remembered as a joke in the history books.”The Chinese Ministry of Commerce confirmed the tariff increase on U.S. goods from 84% to 125%, effective April 12. The official statement warned, “If the U.S. continues to blatantly violate China’s interests, we will not hesitate to take stronger measures.”President Xi Jinping: “China Will Not Bow—Our Strength Comes from Within”Speaking publicly for the first time on the issue, Chinese President Xi Jinping addressed the trade dispute during a meeting with Spanish Prime Minister Pedro Sánchez. “China has never relied on the mercy of other nations. The more pressure we face, the stronger we become,” Xi said. He also called on the European Union to unite in defending global economic stability and resisting unilateral coercion.How Are Global Markets Reacting?Although Asian markets initially responded with optimism, financial experts warn that prolonged trade tensions could significantly increase the risk of a global recession.Turkish President Recep Tayyip Erdoğan also weighed in with a striking statement: “A storm is coming that will affect everyone, large or small. The deeply rooted global system is cracking at its core,” he said, highlighting the potential for widespread economic disruption.Are We Entering a New Era of Global Trade?The U.S.-China trade conflict has clearly entered a new phase. These escalating measures are not just about economics—they’re reshaping international alliances, diplomatic relations, and global market dynamics.While the future of this economic showdown remains uncertain, one thing is clear: this trade war may play a defining role in the future of the global economy.

The New Hampshire State Assembly has passed the Bitcoin Reserve Act.

Digital assets are steadily carving out a more prominent place within the global financial system—and the latest spotlight is on the northeastern U.S. state of New Hampshire. In a historic move, the state’s House of Representatives has approved a groundbreaking bill that would allow public funds to be invested in Bitcoin and precious metals. Known as HB302, the bill passed on April 10, 2025, with 192 votes in favor. All eyes are now on its fate in the state Senate.Bitcoin in Public Funds: A First in the MakingIf HB302 passes the Senate and receives the governor’s signature, New Hampshire could become one of the first U.S. states to officially recognize Bitcoin as a strategic reserve asset. This isn’t just a symbolic gesture—it’s a powerful indication that digital assets are gaining legitimacy in the realm of public finance.The bill allows up to 5% of the state’s general fund to be allocated toward “qualified assets,” a category that includes traditional commodities like gold and silver, as well as digital assets with a market capitalization exceeding $500 billion. At present, Bitcoin is the only digital asset that meets this threshold.What Does It Mean?New Hampshire’s annual budget stands at approximately $3.6 billion. Should the bill be enacted, up to $181 million in public funds could be directed toward Bitcoin and precious metals. Based on current prices, this amount could translate to a potential acquisition of around 2,269 BTC—a striking figure for a government institution.Other U.S. States Are Moving TooNew Hampshire’s initiative is part of a broader national trend as more U.S. states begin to explore digital assets as part of their fiscal strategies. Here’s a snapshot of what other states are doing:Texas has already passed a Senate bill allowing public fund investments in Bitcoin.Florida has introduced similar legislation in its state House.Arizona is considering allocating up to 10% of its funds to Bitcoin.Oklahoma is drafting a strategic reserve bill.Minnesota and Kentucky are working on proposals that include investment permissions and tax incentives.Maryland is exploring a plan to build Bitcoin reserves using gaming revenue.These developments suggest that digital assets are no longer just tools for individuals or private companies—they're becoming recognized as legitimate instruments for public financial management.A New Era for Government Finance?New Hampshire’s move could signal a major shift in how governments manage their finances. As states look to diversify portfolios, hedge against inflation, and enhance economic resilience, Bitcoin and other digital assets are emerging as viable options.Whether this will inspire similar moves from other U.S. states—or even from governments abroad—remains to be seen. But one thing is clear: Bitcoin is no longer confined to the private sector. It’s officially on the public policy agenda.Are We on the Brink of a New Financial Era?What’s unfolding in New Hampshire reflects a broader trend: cryptocurrencies are moving beyond the realm of experimentation and into the domain of policymaking. If this process moves forward smoothly, it may only be the beginning.Governments are starting to recognize and embrace the opportunities brought by the digital age. As digital assets become more embedded in financial governance, we may be witnessing the dawn of a new era in public finance.

Daily Market Summary with JrKripto 11 April 2025

You can find our article “Daily Market with JrKripto” below, where we have compiled the most important developments in global and local markets. Let's analyze the general market conditions together and take a look at the latest assessments.Bitcoin (BTC) is currently trading at $82,100. The price has recovered from the $75,930 support with the strength it received and has approached the $82,819 level. If this resistance level is exceeded, it can be expected that the rise in BTC will continue to the levels of $ 85,419 and $ 92,214. However, if the price retreats with sales from the $82,819 level, the $75,930 support can be retested. If it falls below this level, the support levels of $ 73,804, $ 69,615 and $ 67,496 may be raised, respectively.Ethereum (ETH) is trading at $1,560. ETH, which has received an upward reaction from the $1,486 support, may move towards the $1,585 resistance in the short term. When this level is exceeded, it is possible for the price to rise towards the $1,900 and $ 2,000 levels. A close above $2,000 could allow ETH to reach its targets of $2,277 and $2,428. On the other hand, if the level of $1,486 goes below again, retreats to the levels of $ 1,370 and $1,217 may be on the agenda.Crypto NewsChina is increasing the customs duty on US goods to 125%.The New Hampshire State Assembly has passed the Bitcoin Reserve Act.Ross Ulbricht Will Make His First Public Appearance at the Bitcoin Conference in Las Vegas.President Trump has said that the first tariff deal is very close."Inflation is down, jobs are up, and America's Golden Age continues," the White House said.VanEck has applied for the AVAX ETF.The EU is considering suspending measures against the US tariffs, which are scheduled to take effect on April 15, for 90 days.CryptocurrenciesThose Who Have Risen The Most:XCN →increased by 81.7% to $ 0.0222.ORCA →jumped 46.6% to $2.83.XYO →increased by 34.6% to $ 0.0112.POPCAT →increased by 28.8% to $0.2099.CRV →increased by 20.9% to $ 0.6161.The Ones Who Fell The Most:PLUME → fell 6.8% to $0.1591.UXLINK → fell by 6.6% to $0.5747.DEXE → fell 6.0% to $14.86.PRIME → fell 5.8% to $3.07.NEO → fell 5.6% to $5.26.Other Data:Fear Index:Bitcoin: 25Ethereum: 22Dominans:Bitcoin: 63.28% ▲ 0.03%Ethereum: 7.38% ▲ 0.33%Total Net ETF Inflows Per Day BTC ETFs: -149.50 Million$ ETH ETFs: -38.80 Million$ Data to Follow TodayProducer Price Index (PPI) (Monthly) (Mar): Expectation: 0.2% / Previous: 0.0% / 15:30Global MarketsThe ongoing trade wars between the United States and China and the selling pressure in the long-term bond market have been Decoupled by steep losses in US stock indexes. The S&P 500 index lost 3.46%, the Dow Jones lost 2.50%, and the Nasdaq lost 4.31%. Of the 11 main sectors in the S&P 500, only one ended the day in a surplus: the consumer essentials sector rose 0.21%. Infrastructure shares, on the other hand, showed a resilient outlook with a limited decline of 0.63%. The weakest performances were seen in the energy sector with a loss of 6.40%, technology with a loss of 4.55% and telecommunications and discretionary consumption sectors with a loss of 4.15%.US President Donald Trump has announced that he has increased the customs duty imposed on China to 145%. This development has increased the unease in global markets. On the other hand, although the 30-year bond auction was successful, selling pressure continued in the bond market. While short-term bonds were watching buyers, the 10-year bond rate ended the day at 4.42% and the 30-year bond rate at 4.87%.The weakness in the Dollar Index continues; the index lost 1.94% to 100.91. In this decline, the fact that the inflation data for March announced in the United States fell below expectations was effective. Headline inflation was 2.4% year-on-year, lower than the expected 2.5%. On a monthly basis, while an increase of 0.1% was expected, there was a decrease of 0.1%. Core inflation also rose by 2.8%, below expectations of 3.0% annually, and by 0.1% on a monthly basis instead of 0.3%.The decline in the prices of some service items had an effect on the low inflation rate. In particular, air ticket prices fell by 5.3%, accommodation services by 4.3% and car insurance by 0.8%, dragging down core inflation. These developments have increased expectations of a weak outlook for the airline sector. In headline inflation, the decrease in energy prices by 2.39% was effective, while rent inflation followed the current trend with an increase of 0.33%.Today, the Producer Price Index (PPI) and the University of Michigan Consumer Confidence Survey will be followed in the United States. While a mixed course is observed in Asian markets, European indices are expected to start the day horizontally and slightly positive.The Most Valuable Companies and Their Stock PricesApple (AAPL) → market capitalization of $2.86T, price per share of $190.42, a decrease of 4.24%Microsoft (MSFT) → market capitalization of $2.83T, price per share $381.35, down 2.34%NVIDIA (NVDA) → market capitalization of $2.62T, price per share of $107.57, a decrease of 5.91%Amazon (AMZN) → market capitalization of $1.92T, price per share of $181.22, a decrease of 5.17%Alphabet (GOOG) → market capitalization of $1.88T, price per share of $155.37, down 3.53%Borsa IstanbulBorsa Istanbul cannot perform strongly enough despite the positive mood in global markets. The BIST 100 index ended the day with a rise of only 0.7%, failing to maintain its gains during the day after having a positive opening exceeding 3% in the first hours of the day yesterday. Although the money inflow and outflow seems balanced on a daily basis, when we look at the weekly data, it is seen that serious foreign investor outflows and CBRT reserve utilization continue on both the stocks and bonds sides. Although risk pricing in TL assets has gained some balance, the market's momentum is still weak. For this reason, we think that it is necessary to be cautious in short-term positions.Technically, the 9.000–9.100 band with the 9.270 level and the 9.000-9.100 band stand out as important support areas for the BIST 100 index, while the 9.500 resistance can be monitored in upward movements. In yesterday's trading, the index ended the day at 9,339, retreating after testing an intraday high of 9,581. The 9.473–9.594 band, which was tested intraday, remains important as a near resistance. In case of persistence above this level, optimism may increase in the index in the short term and a move towards the 9.738–9.895 resistance zone may be on the agenda. However, if the downward pressure continues, the 9.221 level will stand out as a close support, while the 9.044–8.870 band will play a critical role as the previous bottom zone. If it hangs below this support band, the 8.618 level may be raised again.On the macroeconomic data side, the industrial production index (SSE) for February declined by 1.6% month-on-month and 5.2% year-on-year, adjusted for seasonal and calendar effects. When adjusted for calendar effects, the annual contraction was calculated as 1.9%. On a quarterly basis, SUE recorded an increase of 0.9%. This decline in industrial production indicates a gradual slowdown in economic activity.On the construction side, there is a slowdown in the cost increase rate. In February, the construction cost index increased by 1.24% month-on-month and by 23.94% year-on-year. On a seasonally adjusted basis, the monthly increase was calculated as 1.8%.Today, retail trade and turnover indices will be followed by the CBRT Market Participants Survey in Turkey. An increase in inflation expectations may be observed in the survey results. While abroad, the US PPI data will be announced. It is estimated that there may be a similar trend in PPI after the CPI, which came in below expectations yesterday.Turkey's 5-year CDS premium starts the day at 362 basis points. This shows that there has not yet been a serious improvement in the perception of foreign investors. As a matter of fact, according to the data announced yesterday, foreign investors sold $ 445 million in stocks last week. Its total foreign output in the last three weeks has exceeded $ 1.5 billion.Monday Decrees balance of payments statistics to be announced and the CBRT Monetary Policy Board (CPPC) meeting to be held on Thursday are among the prominent agenda items in the market next week. The general expectation of the market is that the CBRT will leave the policy rate unchanged at the April meeting. In addition, analyst forecasts for banks' balance sheets for the first quarter of 2025 may also have an impact on pricing.The Shares That Increased The Most:SONME → increased by 10.00% to 136.40 TL.RUZYE → reached TL 11.23 with an increase of 9.99%.VERTU →increased by 9.98% to 37.02 TL.BAKAB → increased by 9.96% to 34.90 TL.EUHOL → increased by 9.95% to TL 14.36.The Most Declining Shares:HDFGS → fell by -8.47% to TL 1.73.BJKAS → fell by -6.71% to TL 3.20.KATMR → fell by -6.44% to TL 2.18.ENSRI → fell by -6.04% to TL 20.84.ERSU → Decreased by -5.37% to TL 15.85.The Companies with the Highest Market Capitalization in Borsa Istanbul:QNB Finansbank (QNBTR) → Market capitalization of TL 1 trillion, price per share is TL 299.00, a decrease of 0.25%.Aselsan Electronics Industry (ASELS) → Market value of TL 561.34 billion, price per share is TL 120.20, a decrease of 2.36%.Garanti Bank of Turkey (GARAN) → market value of TL 443.10 billion, price per share is TL 106.40, an increase of 0.85%.Turkish Airlines (THYAO) → market value of TL 422.28 billion, price per share is TL 308.50, an increase of 0.82%.Koç Holding (KCHOL) → Market value of TL 379.12 billion, price per share is TL 146.60, a decrease of 1.94%.Precious Metals and Foreign Exchange PricesGold: 3901 TL Silver: 38.52 TL Platinum: 1159 TL Dollar: 38.05 TL Euro: 42.92 TL Hope to meet you again tomorrow with the latest news!

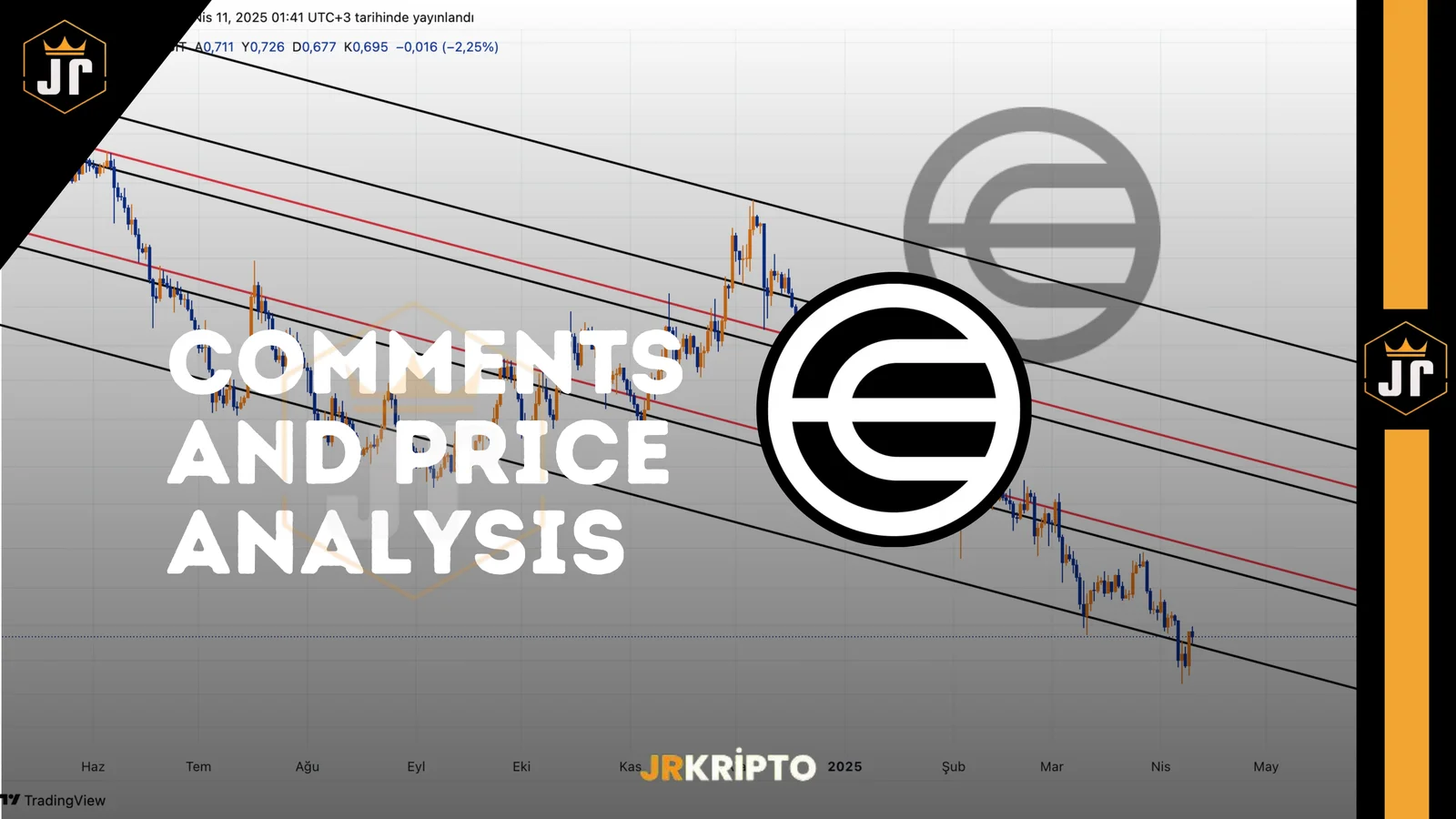

WLD: Comments and Price Analysis 11.04.2025

Worldcoin (WLD) Technical Analysis: The Effort to Hold On to Critical SupportWorldcoin (WLD) continues to be priced in a falling channel movement that has been ongoing since the ATH level it made about 1 year ago. The price is currently located exactly at the lower limit of this channel structure, that is, above a level that we can call the bottom in a technical sense. The current price is at $ 0.708, and this region appears as an important support area both according to the trend line and past price behavior. WLD Trend Support After some positive factors such as positive developments in customs decisions, CPI data, positive opening in US Stock Markets in recent days, the price received a reaction from $ 0.58 to $ 0.70, experiencing a recovery in a short time in the support area that appears in the bottom zone of the channel level, receiving a reaction as it should.What is noteworthy on the chart is that the price has tested the channel many times and produces reaction movements every time it comes to the lower band. This shows us that the trend structure is still technically working. The current movement may be a classic scenario in which this channel is tested again and a reaction is sought. In this scenario, if it continues to produce similar movements, an upward process may begin to the $ 2.00 levels, which are the upper band of the channel, in the medium term. In this process, the decisions in world finance and the FED's May interest rate decision will be very influential.FED Rate Cut, steps back on Customs Duties, etc. with such decisions, there will be high amounts of money inflow to High-Risk Investment Instruments. One of the coins that will benefit the most from this money entry, WLD, which is the representative of the Artificial Intelligence hype in crypto that started with Nvidia, will get a big share of this pie. Worldcoin, which has moved to the upper channel of the falling trend with these positive developments, can break this trend and turn the falling trend formation into a rising trend and be an opportunity for us to start a new ATH journey.Medium-Long-Term Support and Resistance ZonesSupport Levels:$0.680 – $0.700: Channel subband, current retention zone0.560 – 0.600$: The next support line to follow if a sub-breakage occurs$0.480 and below: Oversold zone – major risk levelResistance Levels:$0.850 – $0.950: The first recovery target$1,300: Midband - significant resistance to intra-channel upward movement$1,700: Strong resistance to break for above channel$ 2,700+: Long-term target region – the upper band of the channelAfter examining the long-term support-resistances, the position of the trend structure, possible scenarios, let's look at where we are in the short-term now. WLD Short Term As we saw on the chart, after receiving a reaction from the lower channel of the long-term falling trend, the price has reached this point with a rapid recovery process, has turned the $0.689-0.705$ channel, which often works as a support during the month, breaks and turns into resistance during the last decline, breaking upward again and turning into a support position. With the persistence above this point, the $0.80 level will be the first short-term target with positive developments in the market. After a short correction of $ 0.75 from this point, it can make a break by testing the resistance of $ 0.80 again along with a voluminous purchase request. With this breakdown, the short-term negative market structure will turn positive with the MSB at 0.85.After this turn, the short-term momentum may increase and we may see volume increases until the resistance of the long-term falling trend. The short-term negative scenario will be the scenario in which the price wants to go down again at the closures below $ 0.69 after the fake-break and wants to collect the liquidity left in the region where it made the last dip.Short-Term Support and Resistance LevelsSupport Zones:0.705 – 0.689 $: Instant support line - the price is just above this zone$0.651: The bottom zone of the recent decline$0.600 – $0.580: Extreme correction zoneResistance Zones:$0.752: Resistance likely to be tested in the short term0.801 – 0.820 $: Bulky resistance area - breaking brings strong buying$0.880: The peak where sales were concentrated earlierAs a result, Worldcoin is currently located at the exact lower limit of the falling channel. This means to us that the price will either start a new downward wave or it can move into a strong recovery process from here. The technical outlook shows that the canal structure is still working and the ground is being prepared for a possible return. Now the eyes are on the buyers. If this region is protected, a hopeful story can be written for the WLD again.These analyses, which do not offer investment advice, focus on support and resistance levels that are thought to create trading opportunities in the short and medium term according to market conditions. However, the responsibility for making transactions and risk management belongs entirely to the user. In addition, it is strongly recommended to use stop loss in relation to shared transactions.

Trump's Tax Blow to China: The Customs Rate Has Increased to 145%

April 10, 2025 The trade war between the United States and China has entered a brand new and more violent phase. Dec. 10, 2025. With the recent decree signed by President Donald Trump, the customs duty rate applied to products imported from China has been increased from 125% to 145%. While this increase shook global markets, it also rapidly escalated political tensions.The US Announced Its Decision, China Immediately RespondedWhite House officials confirmed to CNBC that the new tax rate has been implemented. President Trump, on the other hand, in his first announcement from the Truth Social account, harshly criticized China's attitude to the market and stated that the tariffs would be 125%. However, within one night, he revised his decision and increased the rate to 145%.China, on the other hand, did not leave this step unanswered. The Chinese Ministry of Commerce announced that they have introduced a new customs duty of 84% on products imported from the United States. In a statement made by the Chinese Foreign Ministry, in response to the US move, “We will go all the way if necessary,” the message was given. Trump's Decision Global Markets on Alert, Uncertainty EscalatesWhile Trump defends these steps he has taken, he draws attention to the trade deficit between the United States and China.Dec. Trump, who said that the US imports from China are $ 440 billion, but China buys only $ 145 billion of products from the US, considers this situation "unacceptable".However, this tension does not concern only the two countries. Some leaders, such as the Turkish President, say that more caution should be taken. Erdogan warned against the consequences of the tension, saying, "A big hurricane that will affect everyone, not to mention small and big, is at the door, the current global order is cracking."Trump Is Sending a Message to Other Countries As WellTrump's new trade policy is not just aimed at China. Announcing that he had started negotiations on new tariff reductions with more than 60 countries, Trump temporarily implemented a 10% mutual reduction with these countries. Trump says that with this step, many countries are lining up to make a deal with the United States.The Director of the US National Economic Council announced that more than 75 countries want to make new trade agreements with the Trump administration. Trump interprets this situation as proof that his tough economic policies are working and gives a message to everyone "Don't be weak, don't panic".Tensions Are Rising in Global TradeWhile Trump's harsh move against China further escalates the trade war, the temporary discount agreements he has made with other countries are aimed at increasing the bargaining power of the United States. However, China's harsh response shows that this tension will not be calmed down easily. Global markets are expected to feel the effects of this storm much more strongly in the coming days.

Inflation Has Declined, Trump Has Increased the Pressure: Markets Are Waiting for a Rate Cut

The US inflation data released on April 10, 2025 gave a strong message to the markets. The Consumer Price Index (CPI) came in below expectations (2.5%) with an annual rate of 2.4%. This data marks a significant decrease from the 2.8% level recorded in February.The Pressure on the Fed Is IncreasingAs soon as the data was announced, changes in market pricing were observed. Fed fund futures have started pricing in the possibility of a total of 120 basis points of interest rate cuts later this year. While retreating inflation strengthens the signals of monetary easing, the view that the Fed cannot postpone interest rates any longer is becoming widespread.Donald Trump is also closely following this process. In his statements today, he accused the Fed of “taking it slow” and gave a clear message:“This is an economic revolution. And we will win. The result will be historic.”Trump's pressure is not only verbal. While the uncertainty created by customs duties is thought to create an inflationary pressure in the short term, the fact that the announced rates remained below expectations reassured the markets. It is estimated that this situation contributes to the decline in inflation.The White House: "The Golden Age Continues”Following the inflation data, a statement from the White House stressed that ”inflation has fallen, jobs have increased, and America's Golden Age continues." This indicates that the government is preparing the ground for calls for an interest rate cut to make growth sustainable.White House Trade Adviser Peter Navarro's statement ”I expect the market to find a bottom" also strengthens expectations about the possible expansion process.What It Means For Crypto MarketsFalling inflation and upcoming interest rate cuts are creating a positive backdrop for cryptocurrencies. Monetary expansion and cheap liquidity can trigger rises in risky assets, especially Bitcoin.In addition, Trump's interest in digital assets and recent policies reducing regulatory pressures may increase investor confidence.Summarize:US annual inflation is below expectations at 2.4%.It is now highly likely that the Fed will cut rates in May.Trump is ramping up the pressure for a rate cut by openly criticizing the Fed.The White House welcomed the inflation data positively and emphasized the ”Golden Age".For the crypto markets, this environment has bullish potential.

Canary Capital's SUI ETF Move: SEC Filing Filed

The crypto world is moving again. Canary Capital has filed its official application with the SEC through the Chicago-based options exchange CBOE to create a new SUI-based ETF. This step shows that the crypto world is moving closer towards the traditional financial market.SUI is a blockchain network that has recently come to the fore rapidly, attracting attention thanks to its scalability and high transaction capacity. It is known for being practical and convenient for Web3 users and developers. It has a wide range of uses from NFTs to DeFi applications.What Will the ETF Application Bring?If Canary's application is accepted, investors will be able to easily invest through the ETF without having to own SUI tokens directly. This creates a more practical and reliable investment option for individual and institutional investors.The application was filed on form 19b-4 for official approval by the SEC. If approved, the Canary SUI ETF will be traded on the CBOE BZX Exchange under the name "Canary SUI ETF". This development is important enough to pave the way for altcoin-based ETFs not only for SUI, but in general.Canary Capital's strategy is clear: to reach a wider audience by putting its SUI token in front of traditional investors. In addition, the fund also includes staking income, which will allow investors to benefit not only from price movements, but also from network rewards.A New Era May Begin For SUI and AltcoinsIf this ETF is approved, the SUI project will be much more visible, the investor base will expand, and the door to a new era for altcoin ETFs will be opened. Canary Capital's move could further solidify the Decoupling between crypto and traditional finance.