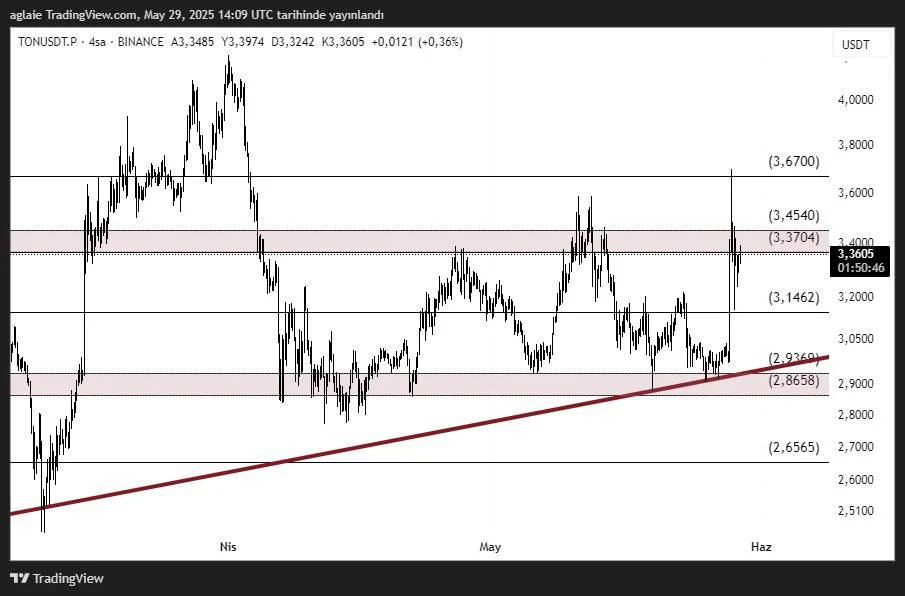

TON 4H Technical Analysis

TON has shown a strong upward move on the 4-hour chart while holding above a key ascending trendline. The bounce from the $2.93–$2.86 support zone provided fresh momentum, pushing the price back up toward resistance. As of now, TON is trading around $3.36, approaching a critical resistance region.

Yesterday, speculative news allegedly involving the TON Foundation sparked sudden demand, accelerating price action with strong momentum. As long as the price remains above the trendline, the technical structure suggests that bullish potential remains valid.

Key Support Levels:

- $2.9360: Trendline level – critical for short-term trading decisions

- $2.8658: Previous liquidity zone and trendline base – expected to act as strong support

- $2.6565: Deeper support; final defense zone in case of a breakdown

Key Resistance Levels:

- $3.3704–$3.4540: Immediate resistance zone currently being tested; price was previously rejected here

- $3.6700: A breakout above this level could indicate a mid-term trend shift

TON has recovered from local lows and rebounded off the ascending trendline, maintaining the higher lows and higher highs structure – a classic signal of a healthy trend. Price is now testing the $3.37–$3.45 resistance band, which previously acted as a major supply zone.

If the price manages to break this resistance with volume, the next target would likely be $3.67. However, if it gets rejected, a pullback toward $3.14 or even $2.93 may occur. As long as $2.93 holds, the bullish trend remains intact.

Conclusion: TON continues to respect its ascending trendline, regaining upward momentum from the $2.93 support. A daily close above $3.45 would confirm bullish control and pave the way toward the $3.67 target.

On the other hand, a breakdown below $2.93 would invalidate the current uptrend, potentially dragging the price toward $2.86–$2.65. For now, all eyes are on the resistance zone and trendline support for the next decisive move.

Disclaimer: This analysis does not constitute investment advice. It focuses on support and resistance levels that may present potential short- to mid-term trading opportunities depending on market conditions. However, all responsibility for trading decisions and risk management lies entirely with the user. The use of stop-loss orders is strongly recommended for any trade setup shared.